#WHAT IS THE DUE DATE FOR A 1065 TAX RETURN PRO#

But, if you’re thinking you don’t have the time or interest in completing your small business taxes, let a Block Advisors small business certified tax pro to assist you in all things tax. We’ll outline the details of these common business entities and their tax filing due dates below. That means that they'll apply to the tax year 2016 (the returns you'll file in 2017) for most taxpayers.Many business owners ask questions like, “When are S corporation taxes due?” And “When are LLC taxes due?” If your business is an LLC, you might file as a sole proprietor, partnership, or corporation, depending on your business structure and even the corporation and partnership tax return due dates. The new due dates apply to taxable years beginning after December 31, 2015.However, if you need to extend your income tax return at the same time, you will need a separate form for the income tax return extension. Accordingly, specific requests for this extension are not required." In other words, if you're looking for an extension form on the site, there's no need: you don't need one. With respect to extensions for FinCEN 114 (FBARs), the IRS has confirmed that " o implement the statute with minimal burden to the public and Fin CEN, Fin CEN will grant filers failing to meet the FBAR annual due date of April 15 an automatic extension to October 15 each year.And for the first time ever, the FinCEN Report 114 has a 6-month period ending on October 15 (with extension rules similar to those at Treas. For forms 3520–A and 3520: 6-month period. For forms 4720, 5227, 6069, 8870: automatic 6-month period beginning on the due date for filing the return.

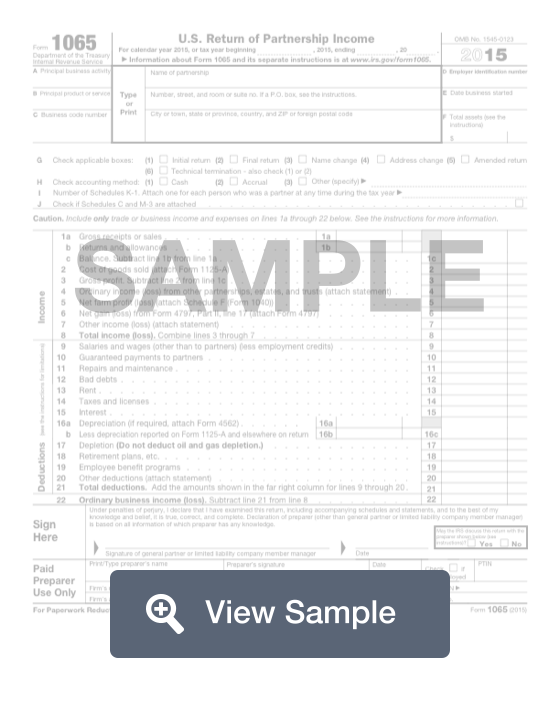

For form 990 (series): automatic 6-month period ending on November 15 for calendar year filers. For form 5500: automatic 3½-month period ending on November 15 for calendar year plans. For form 1041: 5½-month period ending on September 30 for calendar year taxpayers. For form 1065: 6-month period ending on September 15 for calendar year taxpayers.

All of these changes apply to returns for tax years beginning after December 31, 2015, with one exception: C corporations with fiscal years ending on June 30 have ten extra years (yes, ten) to make the change. Note that this is a month later than the previous due date of March 15 for calendar year-end corporations. In both cases (partnership returns and corporate returns), the new law allows for a six-month extension with exceptions for certain corporations through 2026. Note that this is a month earlier than the previous due date of April 15. With respect to C corporation returns, the new due date is the 15th day of the fourth month following the close of the corporation’s year (that would be April 15 for a calendar year-end corporation). With respect to partnership and S corporation tax returns, the new due date is March 15 for calendar year partnerships and the 15th day of the third month after the close of the fiscal year for fiscal year partnerships.

0 kommentar(er)

0 kommentar(er)